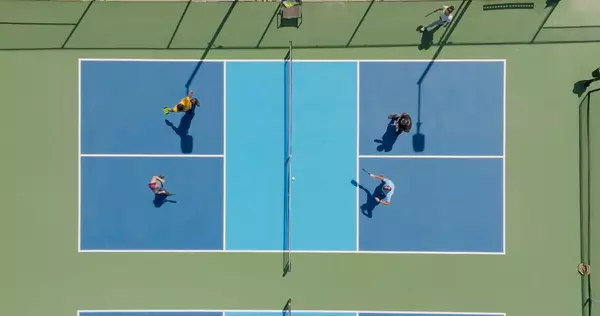

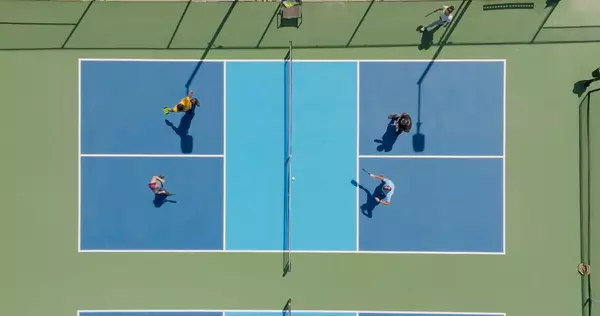

Discover the Joy of Pickleball in South Florida: Your Guide to Getting Started

South Florida beckons pickleball enthusiasts with a host of inviting courts, welcoming players of all skill levels. Embrace the warm weather with the vibrant pickleball scene atm our local picturesque parks. Here's your comprehensive guide to engaging in this dynamic, social sport, observing essential rules, and exploring the top locations for you to enjoy an unforgettable playing experience. Pickleball Essentials: Know the Rules and Etiquette Before you dive into the game, familiarize yourself with these fundamental rules and courtesies to ensure a smooth and enjoyable experience for everyone: 1. Access and Availability: Enjoy access to pickleball courts, operating on a first-come, first-served basis during standard park hours. Dive into the game's intricacies and official regulations by visiting the USAPA's website at www.usapa.org. 2. Player Rotation System: Adopt the paddle rack system to maintain an orderly rotation of players, adhering to the first-come, first-served principle. 3. Appropriate Footwear: Opt for soft-soled shoes to preserve the court's quality and ensure players' comfort. 4. Game Format: Engage in thrilling matches, aiming for a score of 11 and striving for a 2-point lead to clinch victory. 5. Considerate Playtime: Respect a 30-minute play limit when fellow enthusiasts are eagerly waiting their turn. 6. Post-Game Courtesy: Conclude your game and vacate the court promptly if others are awaiting their chance to play. Note that hosting unauthorized tournaments or offering paid athletic services is not permitted on these courts. Your Pickleball Destinations in South Florida Use this website to find an even more detailed list of all the local pickleball courts available in the South Florida area. [Click Here to View] Explore a variety of local picturesque locations, each offering unique facilities to enhance your pickleball journey: - Barrier Free Park, West Palm Beach: A serene setting inviting players of all abilities.- Burt Aaronson South County Regional Park, Boca Raton: Six meticulously maintained courts await west of Boca Raton.- Caloosa Park, Boynton Beach: Eight well-lit courts ensure the game continues even at dusk. Activate the lights by pressing the button on the electrical box near the tennis court parking lot pathway.- Carlin Park, Jupiter: Six courts set against the backdrop of Jupiter's charm.- Freedom Park, West of Jog Rd.: Immerse yourself in a game surrounded by the lush landscapes of Forest Hill Blvd.- John Prince Park, Lake Worth: Six illuminated courts ensure your game extends beyond sunset.- Lake Lytal Park, West Palm Beach: Engage in evening matches on six lighted courts.- Okeeheelee Park, West of West Palm Beach: Six courts nestled in the tranquility west of West Palm Beach.Boynton Beach: Discover this gem at 4305 N Congress Ave.- Patch Reef Park, Boca Raton: A pickleball haven with 15 courts, promising endless fun and competition. For those preferring an indoor setting, visit these multipurpose gymnasiums, each offering indoor pickleball courts: - Diadem, Coconut Creek (Perfect for beginners, offering structured lessons to master the game.) - West Boynton Recreation Center, Lake Worth - Westgate Recreation Center, West Palm Beach - West Jupiter Recreation Center, Jupiter For detailed information on availability and scheduling, kindly visit each facility's official website. South Florida's welcoming parks and dedicated facilities offer the perfect backdrop for your pickleball adventures. Whether you're a seasoned player or just starting, these courts provide a fantastic opportunity to enjoy the game, hone your skills, and connect with fellow pickleball enthusiasts. Let the games begin!

Top 5 Tips For Buying A Home In 2024

Top 5 Tips For Buying A Home In 2024 South Florida's real estate market is as vibrant and diverse as its culture, offering a range of opportunities for potential homebuyers. Whether you're drawn to the pristine beaches of Miami, the tranquil waterways of Fort Lauderdale, or the lively streets of West Palm Beach, finding your dream home in this sun-soaked paradise requires preparation and strategy, especially as we move into 2024. Here are the top 5 tips to effectively prepare for your home search and purchase in South Florida: 1. Understand the Market Dynamics The real estate landscape is ever-evolving, and South Florida is no exception. Before you dive into your home search: - Stay Informed: Keep up with local market trends, such as average home prices, inventory levels, and the average time homes spend on the market. Websites, local media, and real estate reports can be valuable resources.- Seasonal Variations: South Florida's real estate market can be seasonal, with fluctuations in prices and inventory. Understand the best times to buy and how seasonal trends might affect your search. 2. Get Financially Prepared Your financial health is paramount when it comes to buying a home. To position yourself as an attractive buyer: - Check Your Credit Score: Ensure your credit history is in order, as it will significantly impact your mortgage rates and approval chances.- Budget Wisely: Understand all the costs involved in buying a home, including down payment, closing costs, and ongoing maintenance.- Get Pre-Approved: A mortgage pre-approval will give you a clear idea of your buying power and show sellers that you’re a serious and capable buyer. 3. Define Your Priorities South Florida offers a diverse array of properties, from waterfront estates to urban condos. To streamline your search: - List Your Must-Haves: Whether it’s location, number of bedrooms, or amenities, know what you can't compromise on.- Consider Your Lifestyle: Your home should complement your lifestyle. Think about your daily routine, commute, and what you need to live comfortably. 4. Choose the Right Real Estate Professional Navigating South Florida's real estate market can be complex, but the right real estate agent can make all the difference: - Local Expertise: Choose an agent with extensive knowledge of the South Florida market, particularly in the neighborhoods you're interested in.- Reputation and Reviews: Research potential agents, read reviews, and ask for referrals to ensure you’re working with someone who has a proven track record. 5. Prepare for the Buying Process Once you’re ready to start your search, it’s important to understand the steps involved in the buying process: - Home Inspections: Understand the importance of home inspections, especially considering South Florida’s climate and the potential for hurricanes.- Negotiation Skills: Be prepared to negotiate on price, closing dates, and other terms. Your real estate agent will be a valuable asset in this process.- Closing the Deal: Familiarize yourself with the closing process, from the paperwork involved to the closing costs you’ll need to cover. Embarking on your home buying journey in South Florida can be as exciting as it is complex. By staying informed, preparing financially, understanding your needs, working with the right professionals, and navigating the buying process skillfully, you’ll be well on your way to securing your piece of paradise in 2024. Happy house hunting!

VA Home Financing Benefits - For Active Military & Veterans

The VA loan, a unique benefit for veterans and active-duty service members, offers an incredible opportunity for those looking to buy or sell a home. Understanding the nuances of the VA loan process is crucial for both parties to ensure a smooth transaction. This blog post will delve into the most important aspects of buying a property with a VA home loan. Understanding the Benefits VA loans offer several advantages: No Down Payment: Unlike conventional loans, VA loans often require no down payment. No Private Mortgage Insurance (PMI): This can lead to significant monthly savings. Competitive Interest Rates: VA loans typically have lower interest rates compared to traditional loans. Limited Closing Costs: The VA limits the closing costs lenders can charge. Loan Limits: While there's no cap on how much you can borrow, the loan limit affects the down payment. The funding fee varies based on factors like the down payment and whether it's your first VA loan. The VA loan program, a cornerstone of military benefits, offers various options tailored to different real estate goals. Whether you're a buyer or seller, understanding these options is key to a successful transaction. It's important to understand the different types of VA loans, their unique features like assumability, the VA escape clause, and the nuances of using VA loans for primary residences. We'll also touch upon how you can continue using VA mortgage benefits when transitioning to a new home. Types of VA Loans and Their Uses 1. Purchase Loans Ideal for buying a new home, these loans offer competitive interest rates, no down payment requirements, and no need for private mortgage insurance (PMI). 2. Interest Rate Reduction Refinance Loans (IRRRL) Also known as VA Streamline Refinance Loans, these are for refinancing an existing VA loan to reduce the interest rate or switch from an adjustable to a fixed-rate loan. 3. Cash-Out Refinance Loans These allow veterans to refinance a non-VA loan into a VA loan and take cash out from the home's equity, useful for debt consolidation or home improvements. 4. VA Renovation Loans Specifically designed for home improvements, these loans finance both the purchase price and the cost of renovations. 5. Native American Direct Loan (NADL) Program This program helps Native American veterans purchase, construct, or improve homes on Federal Trust Land, or reduce the interest rate on a VA loan. Key Features of VA Loans Assumability VA loans are assumable, meaning a qualified buyer can take over the loan terms. This can be a selling point in a high-interest rate market. VA Escape Clause This clause protects buyers if a property doesn't appraise for the offered purchase price. It allows buyers to rescind their offer without penalty, ensuring they don't overpay. Primary Residence Requirement VA loans are strictly for primary residences. This ensures the program benefits those who need it for their own home, rather than for investment properties. Continuation of Benefits When moving to a new home, veterans can continue using their VA loan benefits. A home sale contingency addendum can be used to synchronize the sale of the old home and the purchase of the new one. Understanding Eligibility and Application Before applying for a VA loan, review the eligibility requirements carefully. Eligibility is based on factors like service duration and discharge conditions. The loan application process requires specific documentation, including the Certificate of Eligibility (COE). For a detailed overview of these requirements, refer to the VA's guidelines and resources. VA loans offer a range of options to suit various real estate goals, from purchasing a new home to refinancing or renovating an existing one. Their unique features like loan assumability, the VA escape clause, and the focus on primary residences make them a valuable tool for veterans and active-duty service members. By understanding the different types of VA loans and their specific requirements, you can make informed decisions and fully leverage this deserved benefit. Remember, these loans are more than financial tools; they're a recognition of service and a pathway to achieving your homeownership dreams. (In addition, to review if a condominium community is elligible for VA financing, please refer to https://lgy.va.gov/lgyhub/condo-report)

Categories

Recent Posts